If you’re a regular reader of this blog, you’ll know that one of the hallmarks of the publishing/marketing/fake literary agency scams that are so prevalent right now is the selling of bogus services.

Sometimes they’re bogus because they’re totally substandard (a la those online clothing companies where the actual garments look nothing like the pictures). Sometimes they’re bogus because they’re never delivered at all. And sometimes they’re bogus because they are 100% fake: international book seals, endorsement reviews, book “re-licensing” (watch for an upcoming post on that one), and more.

This post takes a look at one of the more common bogus scammer offerings, which is notable also because it takes a real element of the publishing industry (book returns) and spins it into a product that does not exist: book returns insurance.

BOOK RETURNS: THE REALITY

One of the many curious facts about publishing and bookselling is that books (for the rest of this post, “books” should be read as “print books”) are sold on consignment. Bookstores and retailers place orders with publishers, are billed for those orders, and then, for any books that remain unsold after a period of time, can return them to the publisher for full credit or refund.

Publishers came up with the idea of returnability during the Great Depression, as a way to encourage booksellers to buy and sell more books. It has become entrenched practice, and despite periodic calls to end it, there’s no sign it’s going away anytime soon.

Online retailers may be flexible about returnability, but brick-and-mortar stores generally will not stock books that aren’t returnable (though they are often willing to special order them if the purchase is paid in advance). While returnability is universal for larger publishers–which rely on print sales for a substantial portion of their revenue–for smaller presses, it’s more of a patchwork. Thanks to distribution challenges, many small publishers’ sales are mostly made online and mostly come from ebooks; print returnability, therefore, may not be a priority. Additionally, for digitally-based publishers returnability can be expensive. With IngramSpark, for instance, it costs nothing to designate a book as returnable–but for any returned books, the wholesale cost plus shipping and handling is charged to the publisher.

Of course, making a book returnable doesn’t guarantee that any bookstore will order it. Nor is brick-and-mortar print presence necessarily a pre-requisite for volume sales, as any number of entrepreneurial self-publishers will tell you. But plenty of newbie authors and hobby writers don’t know that, and still regard brick-and-mortar presence as the gold standard of publishing. Plus, like so many aspects of the publishing industry, book returnability is part of the labyrinth of arcane knowledge that many authors lack.

These factors make book returnability a ripe opportunity for exploitation.

BOOK RETURNS INSURANCE: THE SCAM

A common predatory practice is the selling of returnability for hundreds of dollars a year. It’s a standard offering for many assisted self-publishing companies, like the Author Solutions imprints or Canada’s Friesen Press.

For example, Xlibris charges $699 for its Bookstore Returnability Program. So does Friesen Press. At iUniverse, the Booksellers Return Program is identical to Xlibris’s offering, although it costs $50 more (for no obvious reason).

As noted above, Ingram charges nothing to make a book returnable, so this looks like pure profit. It isn’t quite; the companies do eat the cost of any returned books, and don’t pass that on to the author. But they’re gambling that in most cases, returns will be few enough to still guarantee a tidy return–and that eager authors will gloss over disclaimers like this:

What assurance can Xlibris give that a bookstore will order and stock my book?

Xlibris does not have control over whether a bookstore will order and stock your book. Each bookstore, be it commercial and independently owned, manages its own business operations including which title to stock on its shelves.

Although this practice is predatory, it’s not fraudulent (unless of course you discover that you’re being charged for non-existent returns; I’ve never gotten a complaint about that but I wouldn’t rule it out).

The fraud arises when scammers spin the reality of book returnability into a fake “insurance” product they can sell for exorbitant fees, playing on inexperienced authors’ lack of knowledge and desire for bookstore presence by misrepresenting the way returnability works and employing false promises and sham offers to encourage them to buy.

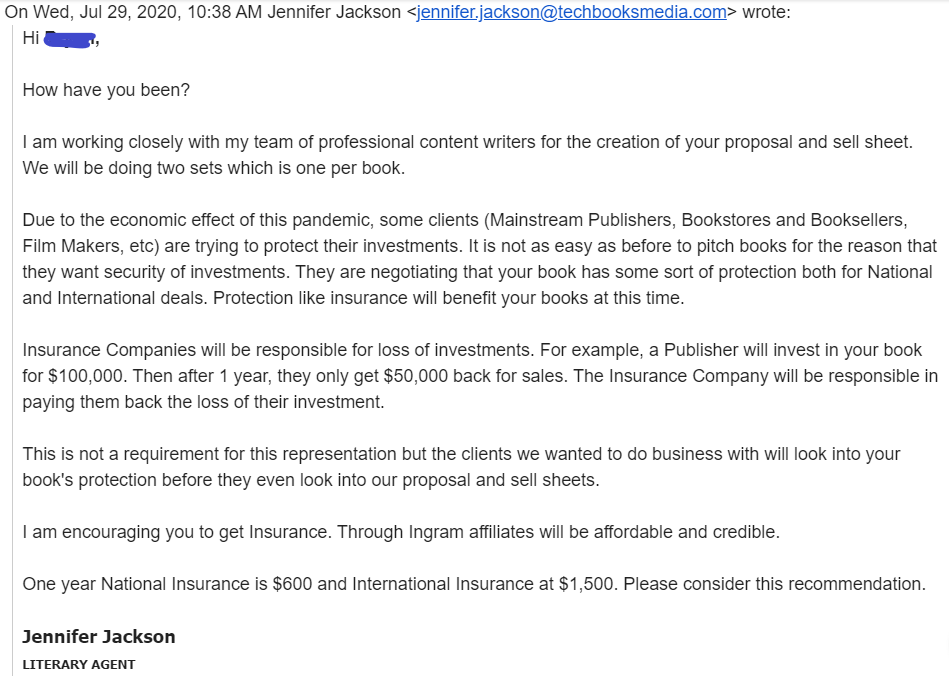

Here’s the first mention of “book insurance” I ever encountered, in 2020, via a solicitation from a literary agent impersonator, encouraging the author to buy an insurance policy to protect publishers from losing out due to unsold books:

This version of book insurance–indemnifying publishers for financial loss–was apparently too preposterous even for scammers; I never saw another example of it. Subsequent iterations, as you’ll see below, focus on booksellers and retailers.

Often, book insurance is folded into a package with other services, such as re-publication. In one such pitch, scammer The Ewings Publishing creatively frames returnability as a special extra: it’s not just returnability; it’s insurance! So much more important and reliable. Even better, there’s a guarantee!

The cost of this fabulous opportunity: $4,999.

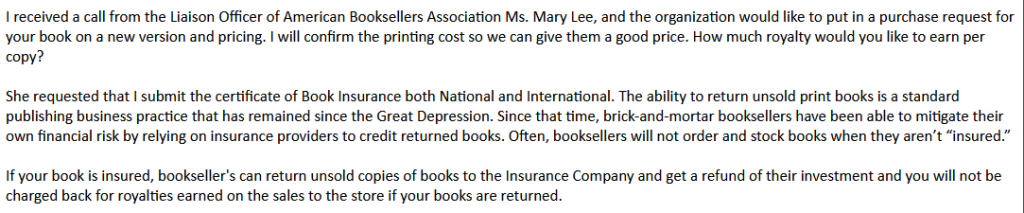

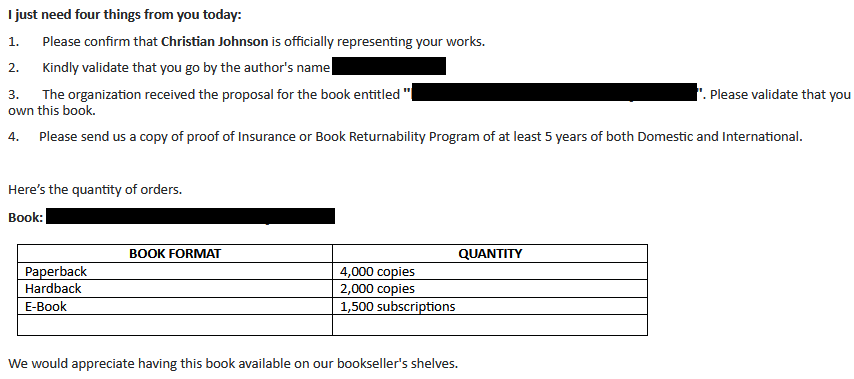

Book insurance is also often pitched as an add-on, after the author has already paid for re-publishing or some other service. Below is an offer from Mark Sanchez of scammer Quantum Discovery; in this version of book insurance, returnability is the purview of “insurance providers”, who also accept the returns. As an encouragement to buy, the scam is packaged as a requirement to fulfill a (fake) book purchase request (which happens to be part of this scam):

Here’s how the author who received this offer described the experience, including the cost, which is made to look like a bargain because it’s “shared”:

This one is from Page Turner Press and Media. Here, book insurance “by Ingram” (which, again, charges nothing to make a book returnable) is part of a “sponsorship” opportunity, with unnamed “investors” who will supposedly share the cost. What a deal! And how convenient that most authors won’t have a clue how to verify that their books really were marked returnable.

This one from faux literary agency Beacon Books Agency throws in the carrot of a “team of experts” tirelessly pitching the author’s book to stores for an entire year–something that, of course, will not happen. By the time the author figures out that the whole thing was a lie, they will have been ghosted.

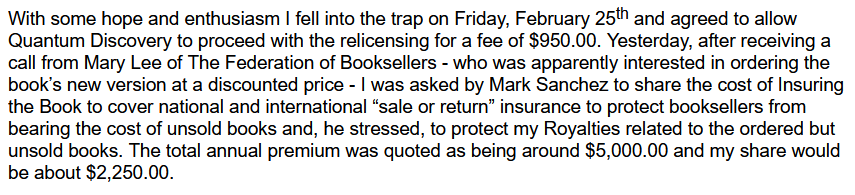

Here’s a pitch from pay-to-play bookstore The Reading Glass Books (more about them here), which exhibits some confusion about what kind of book insurance it’s actually selling (but so what, it’s 80% off!).

This one was shared with me by a client of scammer 20/Twenty Literary (which also runs an audiobook scam that I profiled here). In this case, returns insurance “of at least 5 years” is required as part of a (fake) purchase order from associated scam The Readers Retreat (a company that supposedly helps self-pubbed authors get their books into physical stores). The cost: $9.000.

There are many, many more examples in my files.

UPDATE 2/23/24: Here’s another one, just shared with me today, from brand-new scammer Book Builder Studio (web domain just 69 days old as of this writing). It’s a classic book order scam, and it’s accompanied by this highly bogus letter, purportedly from the American Booksellers Association (the author who received this contacted them, so they’re aware). I don’t know what Book Builder is charging for the supposed requirement of “at least 2 years of returnability”, but it’s a safe bet it’s not less than four figures.

UPDATE 10/7/24: Here’s an example of a bogus “Premium Book Insurance Certificate”, for which the author paid $7,500. This is illegal, by the way.

![Premium Book Insurance Certificate

This document outlines the terms and conditions of the book insurance contract for “[redacted] entered into by [redacted] and Professional Development Agency.

Policyholder: [redacted]

Insurer: Professional Development Agency

Policy Number: 810-0025-3612

Effective Date: July 09, 2024

Coverage Period: July 09, 2024 – July 09, 2027

Coverage Details:

1. Covered Perils: This policy covers loss or damage to books owned by the policyholder resulting from fire, theft, vandalism, accidental damage, or other covered events.

2. Coverage Limits: The maximum coverage limit for this policy is $250,000.00. Any loss or damage exceeding this limit will not be covered.

3. Deductible: The policy includes a deductible of $25.00. The policyholder is responsible

for paying this amount out of pocket before the insurer will provide coverage.](https://writerbeware.blog/wp-content/uploads/2024/02/Returns-Insurance-certificate-1.png)

PROTECTING YOURSELF

How to arm yourself against this (and other) scams?

Educate yourself. Whether you’re self-publishing or seeking traditional publication, knowledge is your greatest ally and your best defense. I’m not minimizing how complicated, confusing, and opaque the publishing industry is; but so many authors dive into the publishing process without taking the time to do even the most minimal learning, and as the emails I receive every day attest, trying to learn on the fly is a recipe for getting scammed. The Writer Beware website (as distinct from this blog) is a good place to start.

Just as important, in this era of solicitation scams: beware out-of-the-blue emails and phone calls! Solicitation is the main way scammers like the ones mentioned above acquire clients, and any publishing- or movie rights-related email or phone call that isn’t directly traceable to a query or contact you yourself have made should be treated with extreme caution. Check my Overseas Scams List to see if the company that contacted you is on it (though keep in mind that the list represents only a particular type of scam, and is only a fraction of the content in Writer Beware’s database).

If you’re still in doubt, email me; I’ll tell you if I have anything helpful in my files.

And remember: book returnability is real. Book returns insurance does not exist.

Thank you for the information. I’d like to know about this Book Insurance Returnability in regard to Crown Literary Agency. They want to republish my book, but are also requesting $800.00 per year for two years making it $1,600.00 I’d like to know how legitimate this is. thank you again

Hi, Sheila,

If you read my post, you’ll know that Book Insurance Returnability, or book returns insurance, or whatever it’s being called, is a scam–a completely fake “service” invented by scammers to enable them to charge large fees to authors. It is never legit.

I’m not familiar with Crown Literary Agency, but if you’re asking about Writers Crown Literary Agency, it’s also a fraud–a fake agency that’s a front for scamming. Scam markers include solicitation (reputable agents rarely contact authors out of the blue, but scammers do it a lot), the selling of “services”, including fake ones like book insurance (real, reputable literary agencies don’t sell services to clients or potential clients), and false claims to have repped traditionally published books.

Has anyone been scammed via Half Price Books with a contract of 10,000 books ordered, which has a 3 year insurance protection. Cost of insurance is $3000

I have been approached by two Publishing Companies AMZN, and Amazon Publishing Central are these legitimate Publishers?

Gary A. Rubin Galan2@aol.com

No. They are scammers fraudulently using the Amazon name and tradmarks to rip you off. See my blog post: https://writerbeware.blog/2023/07/07/how-scammers-are-using-amazon-and-amazon-trademarks-to-rip-writers-off/

“The cost of this fabulous opportunity: $4,999.”

Five thousand dollars is about how much a “good” trade-published book receives in advance, and about five times what a “good” self-published book will earn (I am likely wrong in my estimates). It is my hope that self-published authors do the simple math, and reject this “insurance.” 🙁